what is suta tax rate for 2021

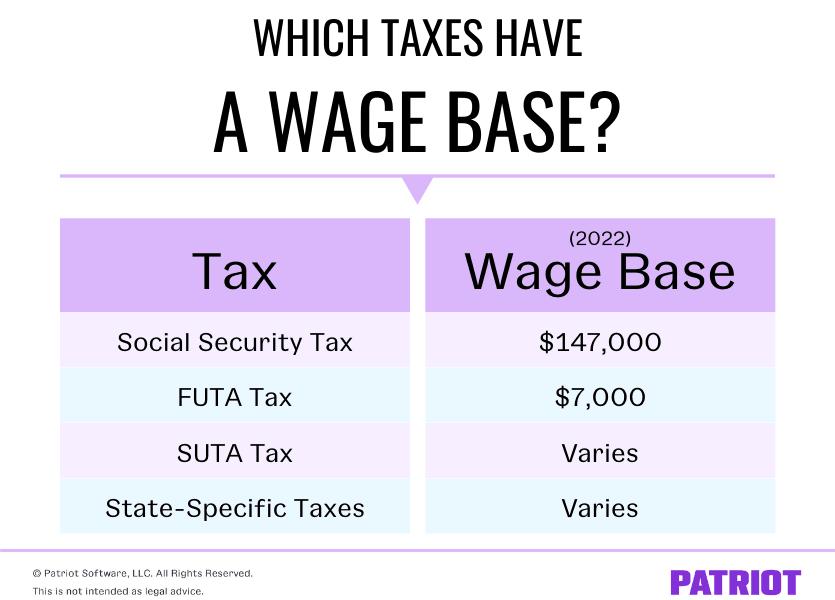

For 2019 the combined FICA rate for employers is 765 which breaks down to 62 for Social Security and 145 for Medicare. This is an increase of 7500 101 from the 2021 taxable wage base of.

What Is Your State S Unemployment Tax Rate Ballotpedia News

Your UI ETT and.

. This chart outlines the 2021 SUTA employer tax rate ranges. If you qualify for the highest credit then the minimum FUTA. 2021 Employer Tax Rate Range.

Rate Year Effective Tax Rate. Understanding FICA Tax Rate and Wage base Limit 2021. The Employment Training Tax ETT rate for 2021 is 01 percent.

An employee will pay 62 Social Security tax on the first 132900 in wages and 145 Medicare tax on the first 200000 in wages 250000 for joint returns. The total of the experience tax and the social tax cant exceed 6. FUTA Tax Rates and Taxable Wage Base Limit for 2021.

The first 7000 for each employee will be the taxable wage base limit for FUTA. There is no change in the JDF Taxable Wage Base amounts or Tax Rates from calendar year 2021 to 2022. Rate Type Rate Maximum cost per employee.

The taxable wage limit is 128298 for each employee per calendar year. The maximum amount you would pay under the FUTA tax credit per employee per year is 42. 145 for employee and employer over 200000 250000 for married couples filing jointly Additional 09 for the part in.

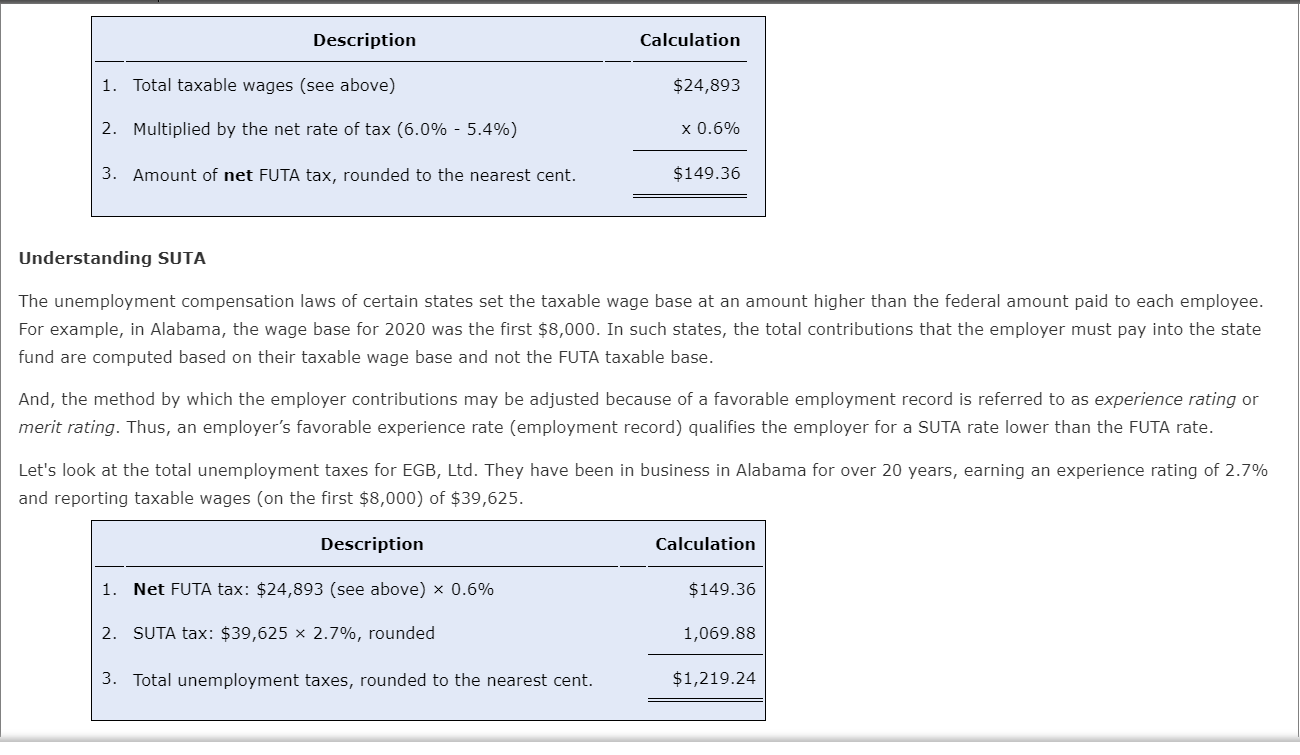

State Unemployment Tax Act SUTA Indiana Code Title 22 Article 4. New Employer Account Registration. The FUTA tax applies to the first 7000 in wages you pay an employee throughout the calendar year.

In all other years the flat social tax is capped at 122. State law instructs ESD to adjust the flat social tax rate based on the employers rate class. Here are steps that you and AccuPay need to take to ensure accurate tax.

For example the SUTA tax rates in Texas range from 031 631 in 2022. The flat social tax is capped at 050 for 2021 075 for 2022 080 for 2023 085 for 2024 and 090 for 2025. This means that any income an employee earns past 7000 is not subject to FUTA tax.

This tax is your personal Social Security and Medicare contributions. Minimum 050 4750. Most states send employers a new SUTA tax rate each year.

Premiums are based on the first 9500 of wages per employee per calendar year. The FUTA rate is 60 and employers can take a credit of up to 54 of taxable income if they pay state unemployment taxes. Some states are still finalizing their 2021 tax information so these tax ranges have been left blank.

Recent legislation changed Floridas reemployment tax rate computation for rates effective 2021 through 2025 The new rate calculation for 2021 excludes all benefit charges from the second quarter of 2020 and prevents the application of the positive adjustment factor which normally increases rates automatically if the trust fund balance is below a certain amount. This practice known as State Unemployment Tax Act SUTA dumping. The State Disability Insurance SDI withholding rate for 2021 is 12 percent.

The FUTA tax rate protection for 2021 is 6 as per the IRS standards. 2022 Taxable Wage Base - 81500 per employee The TDI Taxable Wage Base for Rhode Island employees will be 81500 in 2022. Maximum delinquent rate 940.

However FUTA and SUTA tax. SUTA Rate Notices For 2022. 125000 for married taxpayers filing a separate return.

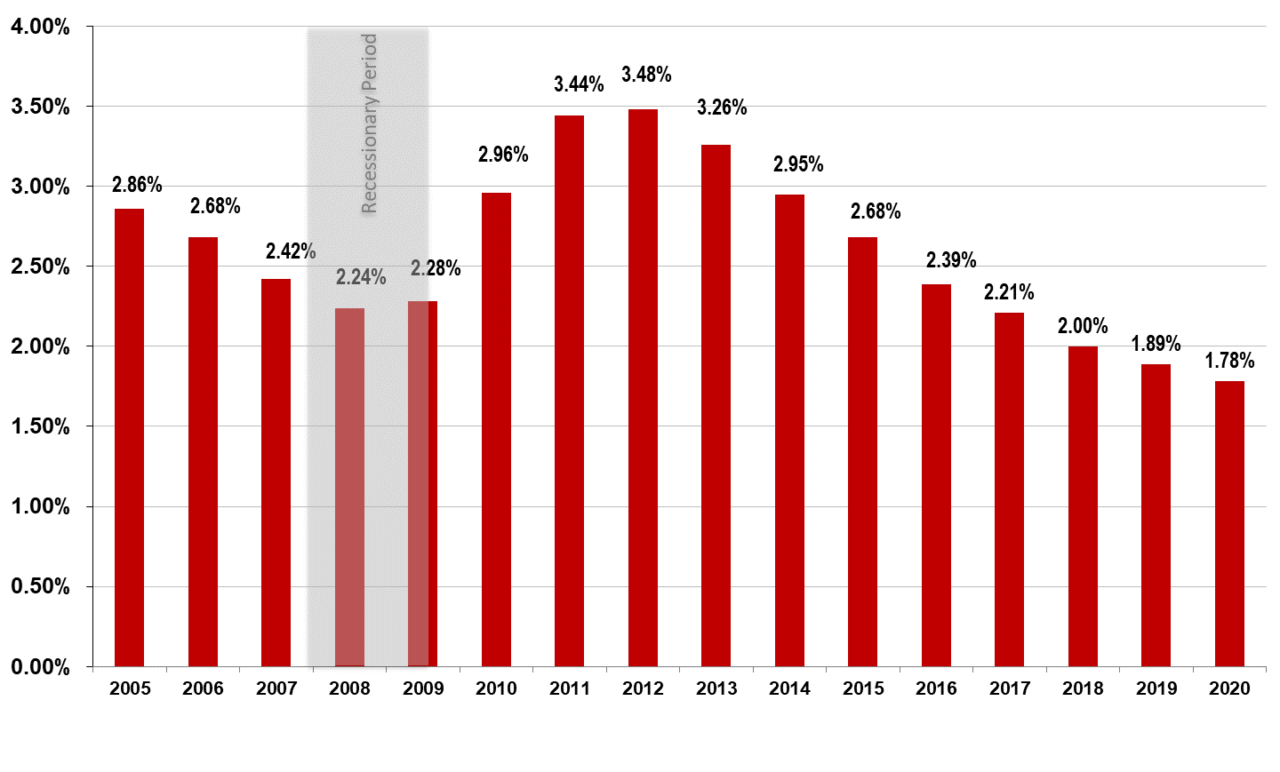

Reimbursing Government Employers Option. The Missouri Employment Security Law bans these practices by mandating transfers of experience rate in certain situations and prohibiting transfers of experience rate in others. Bureau of Labor Statistics News Release State Rates 2009-2017.

Usually your business receives a tax credit of up to 54 from the federal government when it pays its state unemployment tax effectively reducing the FUTA rate to 06. Tax Rates for 2022. The FUTA tax applies to the first 7000 of wages paid to each employee throughout the year.

Employers who have paid wages of 1500 or more in any calendar quarter during 2020 or 2021 and with one or more employees for at least some part of a day in any 20 or more different weeks in 2020 or 2021. Please contact the local office nearest you. Therefore the maximum amount in FUTA taxes an employer would pay annually for each employee would be 7000 x 006 420.

Employers with the maximum credit only have a rate of 06 6 54 on the first 7000 of each employees wages. Most states have their own State Unemployment Insurance Tax Act SUTA or SUI. The largest credit you can receive is 54.

The FUTA tax rate is 60 of the first 700000 of an employees wages during the year. The maximum to withhold for each employee is 153958. FICA Tax Rates Social Security and Medicare Taxes Self Employment Contribution Act Home.

The 2021 new employer rate was 021 percent. This tax is also known as FUTA Liability tax. Check with your state.

The UI and ETT taxable wage limit remains at 7000 per employee per calendar year. The Indiana Department of Workforce Development recently mailed out 2022 Merit Rate Notices to all applicable Indiana employers. 2011 to 2021.

Its worth noting that youll also need to pay SUTA taxes thanks to the State Unemployment Tax Act for your employees as well. Most employers are eligible for a federal unemployment tax credit that reduces their FUTA tax rate. CDTFA public counters are now open for scheduling of in-person video or phone appointments.

Video - Spend Time to Save Money. A government employer may elect to be a reimbursing employer and repay the. Online videos and Live Webinars are available in lieu of in-person classes.

The rate is a combined 153 for the first 132900 of earnings and. Understanding FICA Tax and Wage base Limit. UI Modernization BEACON Information for Employers.

This amount is deducted from the amount of employee federal unemployment taxes you owe. For 2021 the FUTA tax rate is 6 on the first 7000 of eligible income paid annually to each employee. 620 for the employee and 62 for employer Medicare.

For complete SUTA tax rate information visit your states government website. The national unemployment rate 39 percent fell by 03 percentage point over the month and was 28 points lower than in December 2020. If state unemployment taxes SUTA was paid on-time.

You may receive an updated SUTA tax rate within one year or a few years. Your state will assign you a rate within this range. 2022 Annual Tax Rate and Benefit Charge Information.

This 7000 is known as the taxable wage base. Employers must pay a tax rate of 6 on the first 7000 of wages that each of their employees makes. Tax agencies in other states will be sending these notices soon if they havent already.

December 3 2021 Larry the Payroll Guy. Businesses impacted by the pandemic please visit our COVID-19 page Versión en. For questions about filing extensions tax relief and more call.

Typical New Employer 250 23750. SUTA dumping practices include shifting payroll from an account with a higher rate to an account with a lower rate and various restructuring schemes to obtain beginning or lower tax rates. For 2021 the FUTA tax rate is projected to be 6 per the IRS.

In addition to FUTA employer tax employers must also pay a state unemployment tax SUTA to fund unemployment compensation in each state. After the first 700000 employers do not have to pay any further taxes. Maximum in good standing 740 70300.

BEACON Tutorial Videos for Employers. BEACON 20 Account Activation for Employers and Third-Party Agents. Generally states have a range of unemployment tax rates for established employers.

How Much Does An Employer Pay In Payroll Taxes Payroll Tax Rate

![]()

State Unemployment Tax Ballotpedia

How Severely Will Covid 19 Impact Sui Tax Rates Workforce Wise Blog

Ultimate Guide To Sui And State Unemployment Tax Attendancebot

Patriot Software Patriotsoftware Twitter

What Is Sui State Unemployment Insurance Tax Ask Gusto

Guide To State Unemployment Taxes For Multi State Employees

What Is Futa An Employer S Guide To Unemployment Tax Bench Accounting

940 Futa Suta Tax Rates For 2021 Form 940 Futa Credit Reduction States

2022 Sui Tax Rates In A Post Covid World Workforce Wise Blog

What Is Futa An Employer S Guide To Unemployment Tax Bench Accounting

Employer Futa Suta Contributions Understanding Futa Chegg Com

What Is Futa Tax 2021 Tax Rates And Information

Futa Tax Overview How It Works How To Calculate

Oed Unemployment Ui Payroll Taxes

State Unemployment Tax Ballotpedia

What Is A Wage Base Definition Taxes With Wage Bases More

Many Employers Face Higher State Unemployment Insurance Tax Costs Due To Covid 19